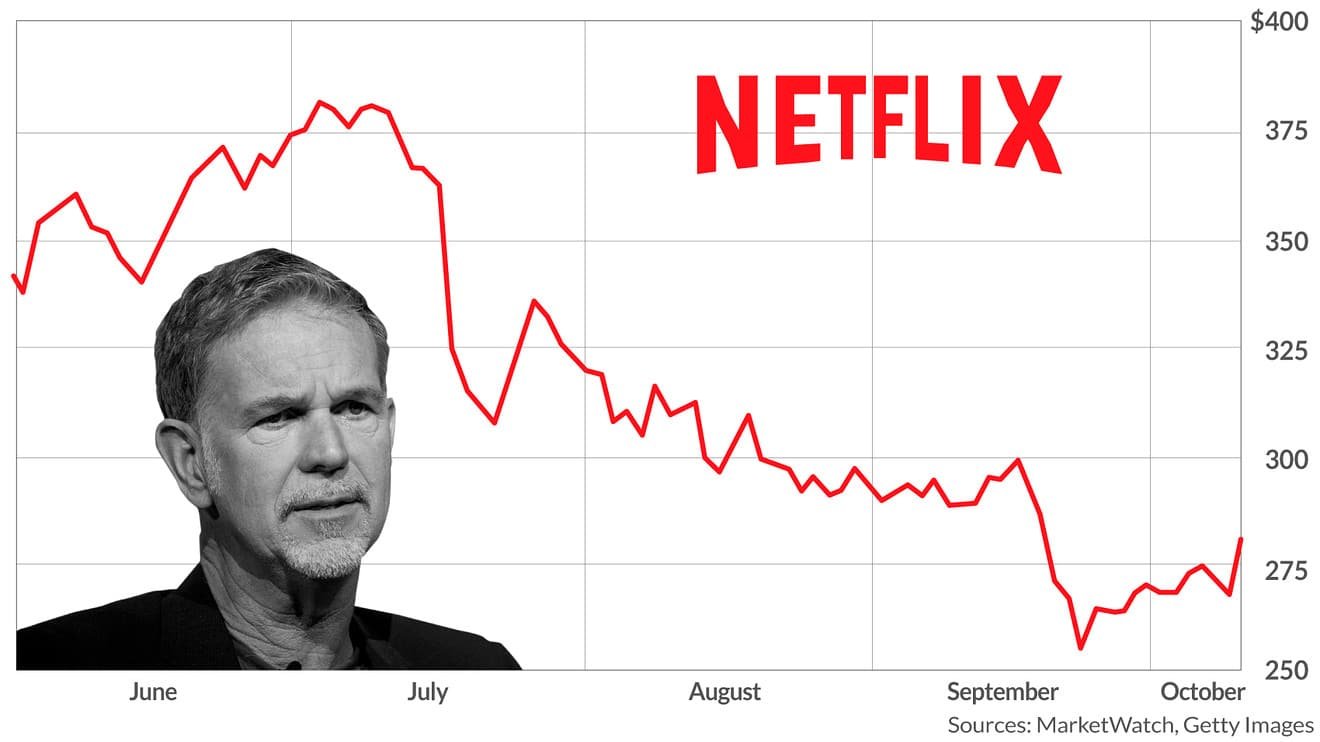

Netflix experienced a sharp decline of over 9% in its stock on Thursday after releasing its quarterly earnings report, which, though generally positive, left investors uncertain about crucial revenue drivers and underwhelmed by the lack of details.

The streaming giant’s shares had rallied 60% year-to-date, driven by the introduction of a cheaper, ad-supported plan and a crackdown on password sharing, both expected to boost growth for the company. However, the quarterly report offered minimal information about these initiatives, and Netflix’s second-quarter revenue fell short of expectations.

Michael Nathanson, an analyst at MoffettNathanson, explained that investors were anticipating stronger revenue growth in the third quarter. Additionally, average revenue per membership showed weakness in the latest quarter as Netflix prioritized its stated revenue drivers rather than increasing prices. The removal of the least expensive, no-ads plan further emphasized the company’s push for the cheaper ad-supported option.

CFO Spencer Neumann mentioned on the earnings call that they postponed price increases during the rollout of the new sharing policy. As for advertising revenue, the company expects a gradual revenue build and does not anticipate it to be a major contributor this year. The ad-supported plan, launched late last year, has so far attracted approximately 1.5 million subscribers, a small fraction of the overall subscriber base.

However, Netflix executives declined to provide specific details about the ad-supported tier during the call, contributing to investor uncertainty.

Neumann emphasized that most of their revenue growth this year results from the growth in volume through new paid memberships, driven by their paid sharing rollout. He expects this impact to increase over several quarters.

Despite the uncertainty surrounding the timeline for revenue-driving initiatives, Wall Street analysts find it challenging to project Netflix’s revenue for the next two years, leading to an unclear outlook for the company.

Wells Fargo analyst Steven Cahall noted that investors’ expectations were high before the earnings report but urged patience afterward, acknowledging that revenue growth might take longer than expected. He cautioned against over-exuberance about paid sharing.

During the investor call, Netflix co-CEO Greg Peters emphasized that revenue growth is not an overnight process, further underscoring the need for patience.

Netflix forecasts third-quarter revenue of $8.5 billion, representing a 7% year-over-year increase.

Despite facing challenges in the entertainment industry due to the Hollywood actors and writers strikes, Netflix has outperformed its legacy media competitors, demonstrating its strength in subscriber growth and revenue focus.

The streaming giant added 5.9 million customers this quarter, following a subscriber loss last year, and has shifted its focus to revenue growth and forecasts. As the entertainment industry seeks streaming profits and faces uncertainties, Netflix remains a key player to watch in the coming months.