The cryptocurrency community is abuzz with the tale of “Hanwe,” a Twitter user who brilliantly outwitted an NFT trading bot, resulting in a staggering 800 ETH profit, equivalent to $1.6 million. This incident has brought the spotlight onto the emerging trend of NFT bot trading, where automated systems engage in copy trading and NFT acquisitions.

In an era heavily influenced by artificial intelligence, the widespread use of bots for diverse purposes has become customary, including the realm of NFTs. Bots such as MevBot and others have previously reaped substantial gains through trading endeavors.

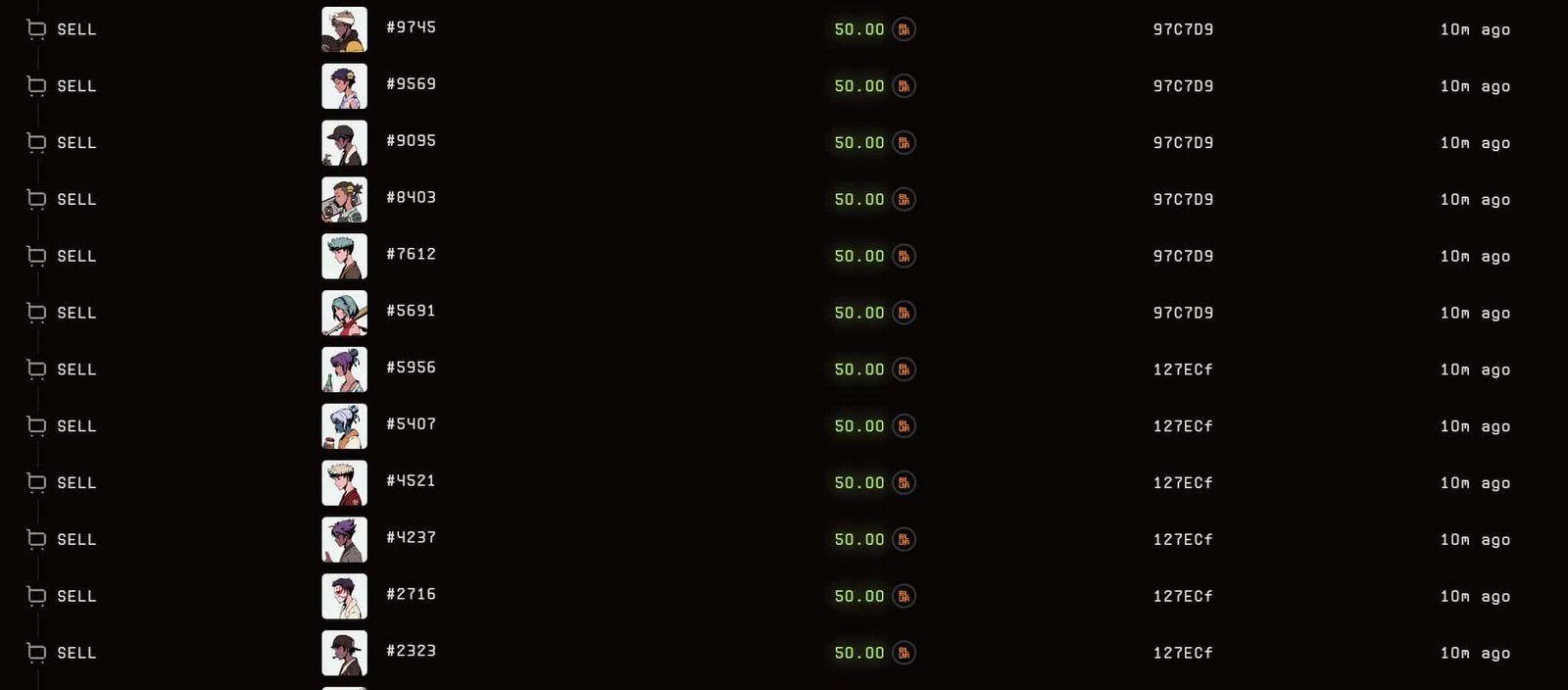

As individuals explore avenues for effortless earnings, bot trading’s popularity has surged, particularly in the NFT arena. The recent incident revolves around a bot that initiated a 50 ETH bid on Azuki NFTs via the blur platform. Subsequently, the bids were accepted, leading the bot to acquire NFTs valued at a staggering total of 800 ETH.

Notably, while the Azuki NFTs’ base price was approximately 5 ETH, the bot purchased them at an elevated 50 ETH per NFT. This sparked widespread speculation on social media, prompting debates on whether the episode was a sophisticated manipulation tactic or a potential scam targeting the NFT market.

In response to the situation, “@hanwechang,” the Twitter user in question, disclosed that they had detected a bot mimicking their bids on blur. In a remarkable move, they deftly devised a strategy to deceive the bot, resulting in the substantial 800 ETH profit. This ingenious maneuver has garnered considerable attention within the NFT community, with admiration for Hanwe’s cleverness in outsmarting the bot.

We would like to discuss a bounty with you. We are offering a 10% bounty of any funds stolen from our bot, which are yours to keep if you return the remaining 90%.

— elizab.ethᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠ (@ThinkingETH) August 5, 2023

Subsequently, the bot’s owner, operating under the Twitter handle “@thinkingeth” and known as “Elizab.eth,” reached out to Hanwe. They extended an offer, proposing a 10% bounty reward for any funds acquired through the bot’s activities. Should Hanwe return the remaining 90% of the funds, they could retain the bounty.

The incident has ignited a flurry of discussions across NFT-focused Twitter threads, showcasing a spectrum of perspectives. While some consider the occurrence a potential scam, others hail Hanwe’s resourcefulness and tactical brilliance. Nevertheless, this incident underscores the crucial need for investor education and awareness, especially in navigating the swiftly evolving landscape of NFTs and automated trading.

As technology propels us into a new era, the Hanwe incident stands as a stark reminder that even the most sophisticated AI systems are not immune to the ingenious strategies of human intervention.

Disclaimer: This article is for informational purposes only and is not intended as financial advice or an endorsement of any actions. The content is based on sources believed to be reliable and accurate as of the time of publication.