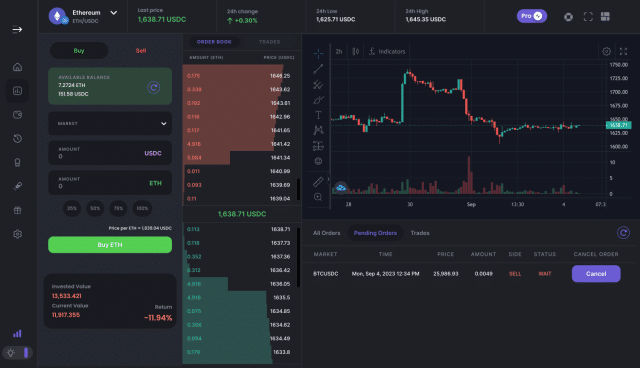

In a captivating development within the cryptocurrency trading sphere, Brine Fi has not only secured an impressive $16.5 million in its Series A funding but has also achieved an outstanding valuation of $100 million. This monumental feat was accomplished through a collaborative effort led by Pantera Capital and bolstered by notable supporters, including Elevation Capital, Starkware Ltd, Spartan Group, Goodwater Capital, Upsparks Ventures, Protofund Ventures, and a group of dedicated angel investors. This substantial financial infusion closely follows Brine Fi’s recent unveiling of its order book platform, a strategic move that has already elevated the platform to a prominent position among global decentralized exchanges (DEXs). Impressively, it now boasts a monthly trading volume surpassing $300 million.

Driving this transformative journey is a dynamic trio of university friends: Shaaran Lakshminarayanan (CEO), Bhavesh Praveen (CTO), and Ritumbhara Bhatnagar (CDO). Together, they have embarked on a mission to confront the challenges currently plaguing cryptocurrency traders. At the core of Brine Fi’s vision is a commitment to addressing inherent issues within DEXs, with a specific focus on mitigating the disruptive effects of frontrunning, a persistent concern for many traders. Frontrunning unfolds when a user places a substantial order on a DEX, rendering this information public and permitting others to execute their orders first at more favorable prices, potentially leaving the initial order unfulfilled. Brine Fi takes on this challenge head-on by harnessing the power of Zero Knowledge Proofs (zkPs) technology, a robust solution designed to safeguard the privacy of trading positions. With this groundbreaking technology in place, traders can execute high-volume orders with unparalleled confidence and ease.

Shaaran Lakshminarayanan, a seasoned figure in the cryptocurrency exchange arena, shared his insights, remarking, “Having previously spearheaded one of the largest crypto exchanges, we have perpetually grappled with the need to diversify user assets across multiple exchanges and venues to mitigate asset loss risks stemming from problematic exchanges or counterparties. With Brine Fi, we streamline this process for institutions, centralized exchanges, HFT traders, and retail users, thereby reducing their counterparty risk while ensuring optimal order execution.”

Brine Fi’s pioneering approach to addressing these pivotal challenges has attracted significant attention from the investment community. Paul Veradittakit, Managing Partner at Pantera Capital, underscored the market’s pressing need for a self-custodial execution layer that not only accelerates transactions and enhances reliability but also prioritizes user-friendliness and cost-effectiveness. He noted, “Brine Fi is tackling some of the most crucial obstacles impeding institutional and mainstream user adoption in DeFi.” Vaas Bhaskar, Principal at Elevation Capital, echoed this sentiment, expressing enthusiasm for continued support of Brine Fi as they strive to simplify the complexities of blockchain technology and make it more accessible to end-users and institutions.