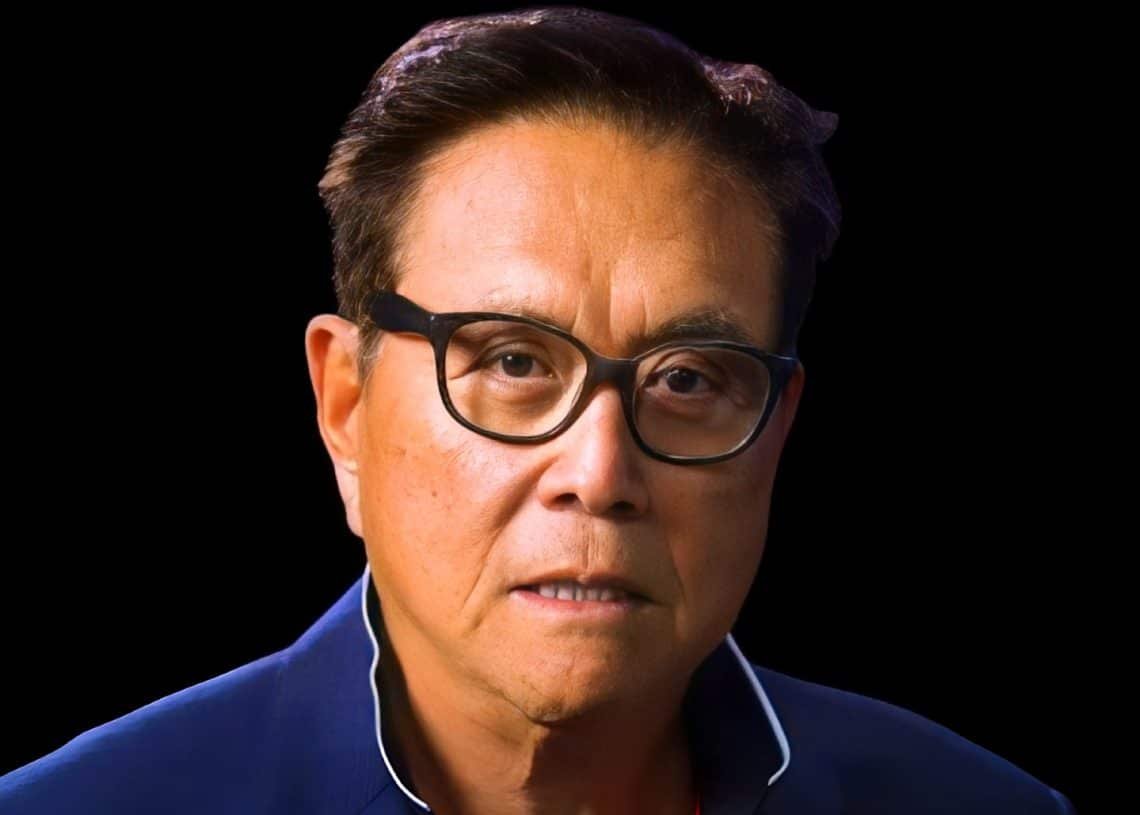

Renowned author Robert Kiyosaki anticipates a seismic shift in the U.S. economy, projecting substantial price surges for Bitcoin and silver while foreseeing a crash in gold prices below $1,200.

Andy Schectman asks a very important question. “Who is going to buy US Bonds?” Banks are buying gold not US debt. How will America run without money? How will the world operate with money? What will you do without money? Gold is going to crash possibly below $1200. Silver will…

— Robert Kiyosaki (@theRealKiyosaki) February 14, 2024

Speaking on social media platform X, Kiyosaki expressed skepticism about the sustainability of U.S. bonds and highlighted concerns regarding the economy’s resilience. He predicts significant gains for silver and Bitcoin, contrasting it with a potential crash in gold prices.

Kiyosaki’s outlook aligns with his previous warnings of an impending economic downturn, as outlined in his book ‘Rich Dad’s Prophecy.’ He emphasizes the historical outperformance of gold over the S&P 500, projecting a substantial crash in the latter.

Despite gold currently trading at $2,013.43 per ounce and silver at $23.41, Kiyosaki advocates for tangible assets over traditional financial instruments due to their historical resilience.

Why I own Bitcoin. Bitcoin is protection against the theft of our wealth via our money. Fed Chairman Powell, Treasury Secretary Yellin, and Wall Street bankers steal our wealth via our money, specifically via inflation, taxation, & stock price manipulation. That is why I save…

— Robert Kiyosaki (@theRealKiyosaki) January 31, 2024

In recent weeks, Kiyosaki has reiterated his support for Bitcoin as a hedge against institutional wealth erosion tactics. He praises Bitcoin’s decentralized nature and inflation-resistant qualities, contrasting them with traditional financial practices.

Kiyosaki’s bullish stance on Bitcoin is shared by business intelligence firm MicroStrategy, which holds a substantial BTC reserve valued at over $5.93 billion. The recent surge in Bitcoin’s price has propelled MicroStrategy’s profits to over $4 billion, sparking discussions about its potential inclusion in the S&P 500 index.

As Bitcoin’s price hovers around $52,134, representing a 7.7% increase in the last week, market analysts anticipate further gains amidst ongoing resistance at $52,000. MicroStrategy’s stock has witnessed a significant rally, positioning the company for potential index inclusion and solidifying Bitcoin’s status as a lucrative investment avenue.