Coinbase Global Inc., the sole publicly traded cryptocurrency exchange in the United States, has laid out a strategic initiative to address its financial debts by embarking on a fundraising campaign aimed at generating over $1 billion. The company intends to accomplish this by offering convertible senior notes to qualified institutional buyers.

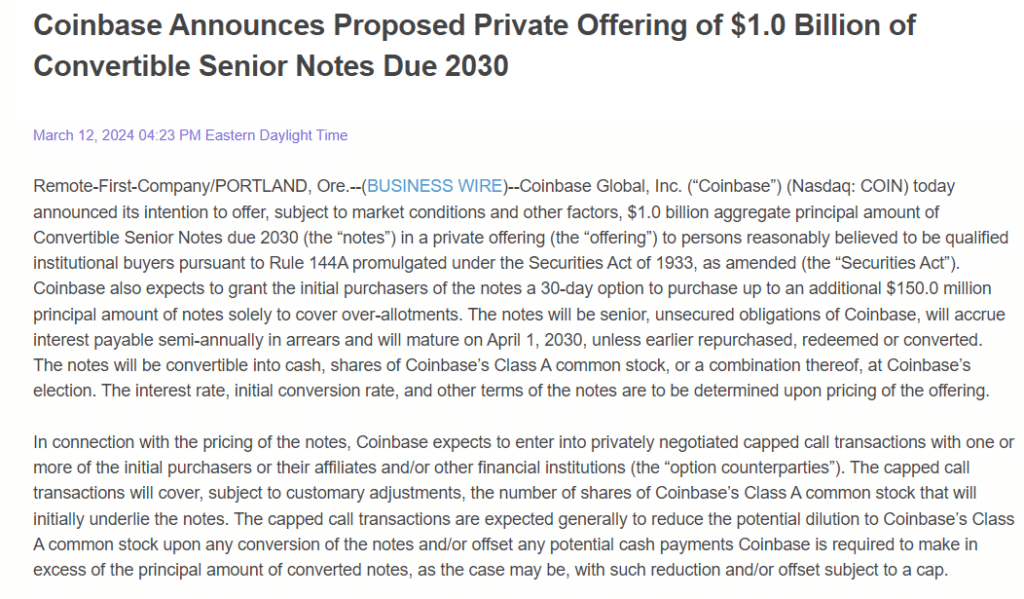

The plan, revealed by Coinbase, involves the issuance of unsecured convertible senior notes through a private offering, a move designed to alleviate the burden of outstanding debts. These notes, set to mature on April 1, 2030, will be made available to institutional investors, with an option for the purchase of an additional $150 million of securities.

According to the company’s statement, the convertible bonds can be converted into cash, shares, or a combination of both, offering flexibility to investors. While specific details such as initial conversion rates and interest rates are yet to be finalized, Coinbase aims to utilize the proceeds from this offering to repurchase or redeem its debts before maturity.

The inspiration behind Coinbase’s strategic approach can be traced to Michael Saylor’s playbook, notably his acquisition of over 205,000 Bitcoin worth $15 billion, funded through MicroStrategy’s sale of convertible notes amounting to over $2 billion. In a bid to mitigate dilution resulting from debt-to-equity conversions, Coinbase plans to implement “negotiated capped call transactions.”

The decision to pursue fundraising comes amidst a significant rally in Bitcoin prices, reaching an all-time high of $73,000, providing an opportune moment for publicly traded companies to capitalize on the bullish market sentiment. Additionally, a shift in Wall Street analysts’ outlook on Coinbase’s stock may have further influenced the company’s decision-making process.

Apart from debt repayment, Coinbase aims to allocate the funds raised towards general corporate purposes, including capital expenditure and the cost of capped call transactions. Founded in June 2012 by Brian Armstrong, Coinbase has emerged as a leading cryptocurrency exchange, facilitating economic freedom for over 1 billion individuals worldwide.

With a robust ecosystem comprising over 245,000 partners across more than 100 countries, Coinbase remains committed to providing secure and accessible avenues for individuals to invest, save, earn, and transact with digital assets. As the company continues to navigate the evolving landscape of cryptocurrency markets, its latest fundraising endeavour underscores its determination to fortify its financial position and sustain its mission of driving economic empowerment through blockchain technology.