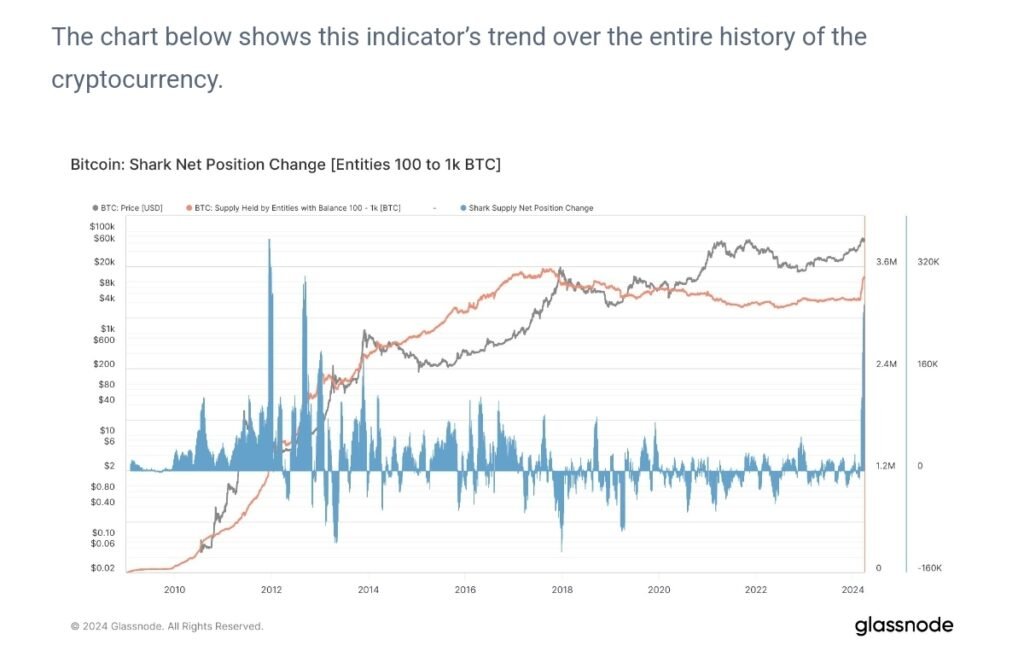

Bitcoin’s largest investors, commonly referred to as “sharks,” have engaged in their most extensive accumulation in nearly a decade. According to recent on-chain data, these entities, holding between 100 to 1,000 BTC each, have collectively purchased over 268,000 BTC in the past month alone, amounting to nearly $18.6 billion in value.

Analysts note that this surge in buying activity by the Bitcoin shark cohort is the most substantial seen since 2012, underscoring a bullish sentiment among large Bitcoin investors. These entities, often considered influential players in the market, have demonstrated a significant vote of confidence in Bitcoin’s long-term potential.

The term “entity” in this context refers to a collection of addresses owned by the same investor, as determined through analysis by the on-chain analytics firm Glassnode. The entities holding between 100 to 1,000 BTC are popularly known as “sharks,” indicating their significant holdings in the cryptocurrency.

At the current exchange rate, the BTC holdings of these sharks translate to approximately $6.93 million to $69.3 million per entity. While these investors wield considerable influence, they are still smaller and less impactful than the category of investors known as “whales,” who typically hold over 1,000 BTC each.

Despite the dominance of whales in the cryptocurrency market, the behavior of sharks remains closely monitored due to their collective impact on market dynamics. One key metric used to gauge their activity is the “net position change,” which tracks the net amount of supply entering or exiting the wallets of entities within the shark group over a given period.

Recent data indicates that the net position change for Bitcoin sharks has been highly positive, indicating a consistent trend of accumulation. Over the past 30 days, these large investors have made net purchases totaling around 268,441 BTC, marking the most significant accumulation seen since 2012.

This surge in buying activity by Bitcoin sharks coincides with a period of notable market performance for the leading cryptocurrency. Bitcoin’s price has reached new all-time highs, buoyed by strong institutional interest and growing adoption.

In addition to the bullish sentiment among large investors, recent data from cryptocurrency exchange Coinbase suggests further positive trends in the market. The exchange has observed significant outflows of Bitcoin from its wallets, with $1.1 billion worth of the asset withdrawn in a single day. This marks the third-largest net outflow this year, indicating a growing preference among investors for self-custody solutions.

Such exchange outflows are often interpreted as a bullish sign for Bitcoin, as they suggest that investors are choosing to hold onto their assets for extended periods rather than keeping them on exchanges. This trend aligns with the broader narrative of increasing institutional adoption and confidence in Bitcoin’s long-term value proposition.

Despite recent price stagnation, with Bitcoin trading around $69,900 at the time of reporting, market sentiment remains positive. The significant accumulation by Bitcoin sharks, coupled with growing institutional interest and favorable on-chain metrics, bodes well for the future trajectory of the leading cryptocurrency.