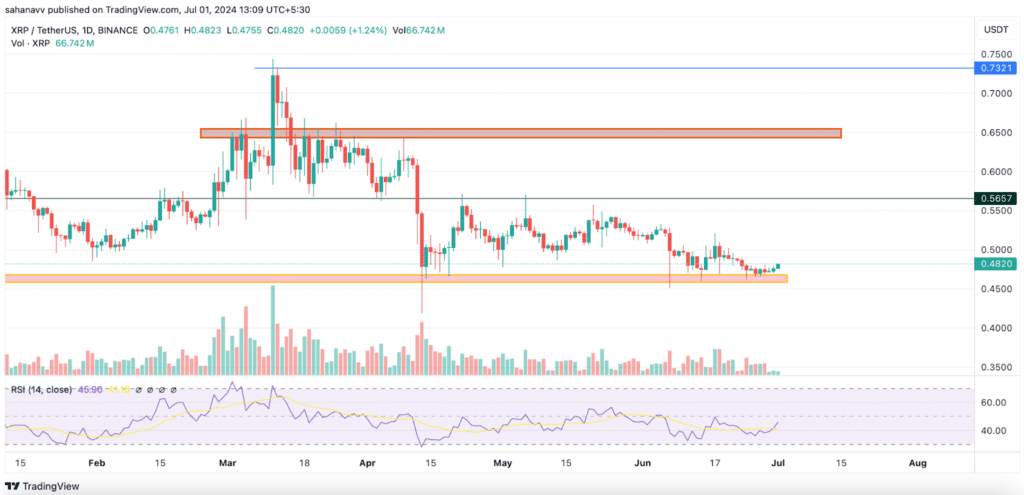

The XRP price has been struggling to break through the $0.48 barrier, causing concerns among traders and investors. Despite various attempts, the token remains restricted below certain levels, resulting in reduced interest and trading volume.

In recent months, XRP has shown a steep descending trend. While many tokens closed the quarterly trade on a bullish note, XRP struggled to defend its lower support levels. This raises questions about the token’s future prospects and whether it will ever reach $1.

Several factors contribute to XRP’s current predicament. One major issue is the decline in trading activity on the platform. Metrics indicate that the token might experience some relief soon, presenting two possible scenarios for July. After a prolonged period of consolidation within a bearish pattern, XRP recently formed a bullish pattern during a rebound. This suggests a potential bullish move, which could increase the price by 25% to 30%, reaching $0.55.

XRP has been consolidating between $0.56 and $0.46 for several months. The price has lost traction, bottoming out along a key support zone. The Relative Strength Index (RSI) has indicated a bullish reversal but has failed to rise above the average. If the RSI levels surge above 60, XRP could rise above $0.50.

Despite these technical bullish signals, the drop in trading activity remains a significant concern. The active address count has been declining since the start of 2024. This decrease in trading activity has kept the XRP price within a restricted range. Only a significant influx of liquidity could increase buying pressure and potentially uplift the price above the current sluggish range.

The future of XRP remains uncertain. While there are potential bullish patterns and signals, the overall market conditions and trading activity will play a crucial role in determining whether XRP can break through its current barriers and possibly reach $1.