Centralised cryptocurrency exchanges (CEXs) experienced a significant drop in trading volumes in June. Data from the WuBlockchain team revealed that crypto spot volumes on CEXs fell by 17% month-on-month (MoM). This decline coincided with a 5% drop in Bitcoin prices and a substantial reduction in the total cryptocurrency market cap.

The bearish sentiment in the digital asset market led to capital exiting the space. Several prominent CEXs recorded notable decreases in trading volumes. Upbit saw a 45% decline, Bitfinex 38%, and KuCoin 32%. Binance, one of the largest exchanges, experienced a 22% drop in spot trading. Coinbase also saw a 15% decline, causing it to lose its second-place global ranking. Bybit moved to the second spot despite a small 1.6% drop in trading volumes. However, MEXC and HTX bucked the trend, with spot activity increasing by 13% and 7%, respectively.

The report also indicated that cryptocurrency derivatives trading volumes mirrored the drop in spot trading. There was a 19% MoM decrease in derivatives trading volumes.

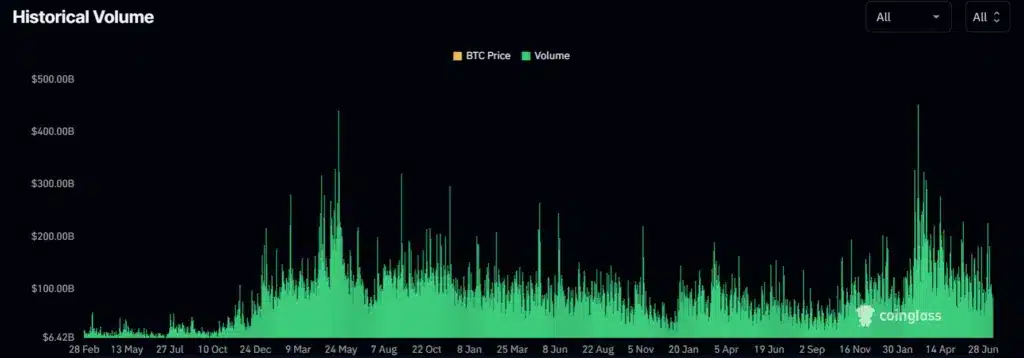

Monday’s report highlighted a broader trend of declining volumes since March. CoinGlass data showed that trading volumes have been decreasing for four months. The highest trading volumes this year occurred when Bitcoin rallied to an all-time high of $73,738, underscoring Bitcoin’s significant influence on the digital asset market.