A former product manager at OpenSea, one of the largest NFT marketplaces, has been found guilty of insider trading in the first trial of its kind involving NFTs. The verdict is a significant milestone in the development of NFT regulation, as courts grapple with the novel legal and ethical issues presented by this emerging asset class.

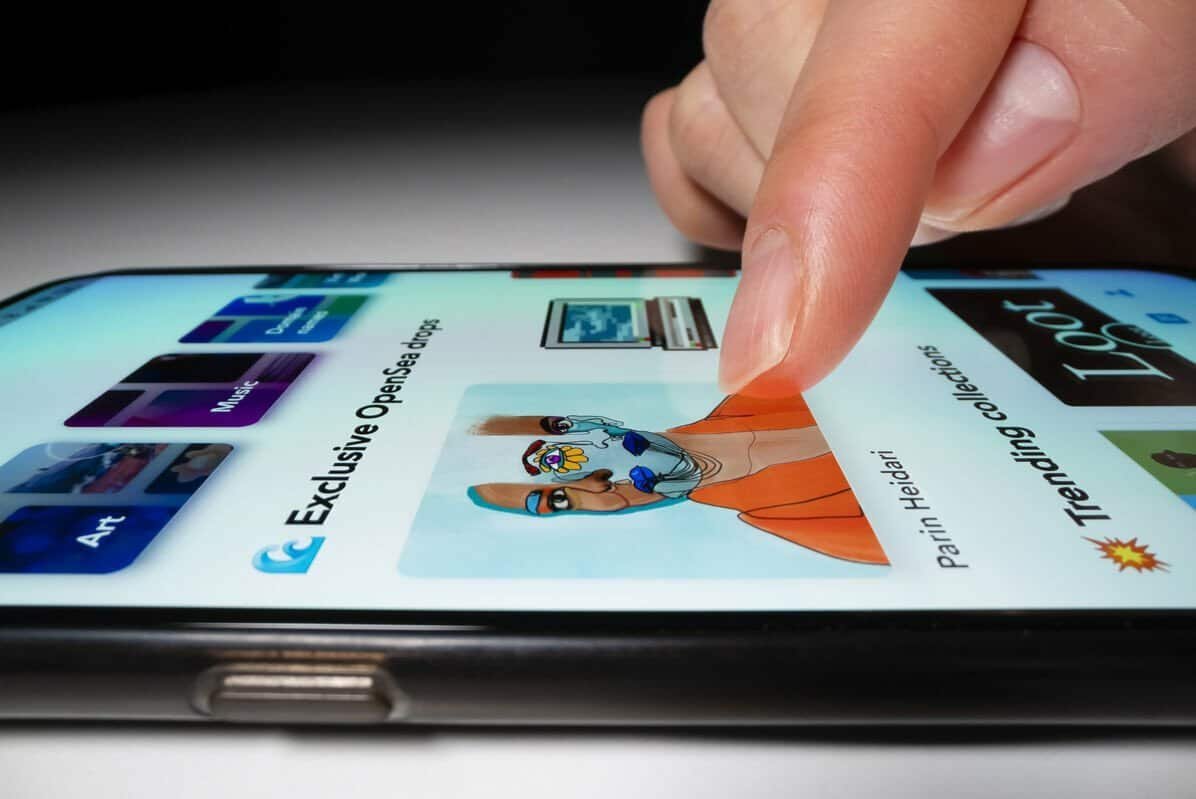

The ex-OpenSea manager had been accused of using his position at the company to gain access to insider information about upcoming NFT drops and then profiting from trading on that information. The case was brought by the US Securities and Exchange Commission (SEC), which has been ramping up its efforts to regulate the rapidly growing NFT market.

The guilty verdict represents a major victory for the SEC, which has been seeking to establish a legal framework for NFTs and other cryptocurrencies. It is also likely to serve as a warning to others in the NFT industry that insider trading will not be tolerated.

The case highlights the challenges of regulating NFTs, which are unique digital assets that can be difficult to define and value. However, the guilty verdict is a positive step towards creating a clearer legal framework for NFTs and protecting investors from fraud and misconduct.

OpenSea has stated that it cooperated fully with the SEC’s investigation and has implemented new measures to prevent insider trading and other forms of misconduct. The company has also emphasized its commitment to transparency and fair trading practices.

The guilty verdict in the first NFT insider trading trial is a significant development for the nascent NFT market and the wider cryptocurrency industry. As the industry continues to grow and mature, regulatory bodies such as the SEC will play an increasingly important role in establishing a clear legal framework and promoting fair and transparent trading practices.