Mike Novogratz, the founder and CEO of Galaxy Digital, has shared his positive outlook on the future of cryptocurrency regulation in the United States. Speaking on CNBC’s ‘Squawk Box,’ Novogratz confidently predicted that no matter who wins the next presidential election, the crypto industry will see favourable regulatory changes.

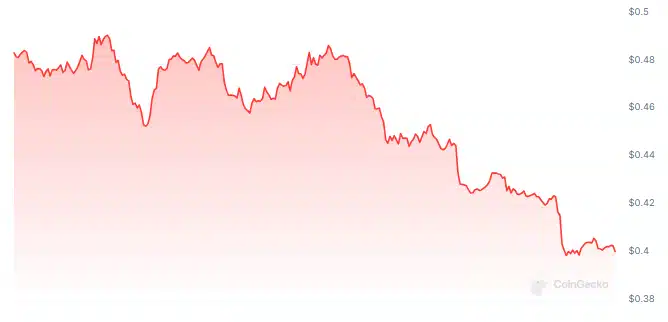

The contrasting approaches to crypto regulation have influenced voter preferences. Prediction market data shows Trump leading with over 60% of votes in the Presidential Election Winner 2024 poll, compared to Biden’s 15%. Despite this, the crypto market remains volatile. Memecoins inspired by the two presidential candidates are experiencing a bearish phase. At the time of writing, Donald Tremp (TREMP) was down by 16.5% in the last 24 hours, while Joe Boden (BODEN) had declined by 27.9%.

Former President Donald Trump has made his pro-crypto stance clear, even accepting cryptocurrency donations for his campaign. This contrasts with President Joe Biden’s administration, influenced by SEC Chair Gary Gensler’s stringent scrutiny of various crypto firms. These differing views on crypto have swayed voters more towards Trump, as seen in prediction markets.

Novogratz emphasized the importance of bipartisan support for cryptocurrency. He stated that crypto needs to be “bipartisan.” This sentiment is echoed by a survey conducted by Harris Poll on behalf of Grayscale, highlighting the significant role cryptocurrency is playing in the 2024 presidential election.

"No matter who wins the next election, we're going to get positive crypto legislation – I know that," says @Novogratz pic.twitter.com/Vq8Xp1TEY0

— Squawk Box (@SquawkCNBC) July 2, 2024

Prominent figures in the crypto industry have weighed in on the challenges of crypto regulation in the US. Ethereum co-founder Vitalik Buterin pointed out that projects with vague purposes face little oversight. However, initiatives that provide clear information about returns and user rights get labeled as securities, subjecting them to stricter regulations. This penalizes transparency, hindering responsible innovation in the crypto space.

Building on Buterin’s point, billionaire entrepreneur Mark Cuban argued that the current regulatory framework is the main hurdle. According to Cuban, crypto companies are willing to register, but the existing system is unfit for the unique characteristics of cryptocurrencies. He likened the situation to forcing a square peg into a round hole, emphasizing that the outdated regulations are the issue, not the companies.

As the 2024 presidential election approaches, the intersection of politics and crypto regulation will shape the industry’s trajectory. Novogratz’s optimism about positive regulatory changes suggests a turning point for the crypto industry, regardless of the election outcome.